Today i’ll go through a walkthrough on creating an esports pitch deck. If you’re new to my blog make sure you check out other articles such as budgeting an esports event, networking in esports and more esports articles.

For the purposes of this article, I’m going to refer to Guy Kawasaki’s 10 / 20 / 30 rule on pitch decks but tailor it for esports specifically. I’ll walk through all 10 slides and give a few examples of my own + mistakes I made along the way. By no means am I an expert in pitch decks but I am simply sharing my experiences.

Before we begin, you should spruce up on your elevator pitch. I would say 99% of the time you’re going to have a very brief window to give your pitch. Make sure it’s succinct and clearly lays out the problem you’re solving + the value proposition. Here’s a good one from Sean Wise my former professor at Ryerson University. He also was a consultant for a few years on a show called Dragon’s Den. You may have heard of it xd.

Also, make sure you don’t pay for any presentations. Ie $50 to present to someone who is a gate keeper. Not worth your time and they’re not serious generally.

As for the pitch deck, let’s discuss.

- Title – Very self explanatory. Company name, name of yourself + title, cell and address if you want.

- Problem / Opportunity – This one should be fairly clear if you have a good idea about what your company does and who their target audience is and the total addressable market is.

- For example, as a tournament organizer in esports, I could say something along the long the lines of:

- Problem: “Traditional media outlets are having an increasingly difficult time advertising to Generation Z (zoom zoomers) and Millenials due to them watching non traditional methods of sports.

- Our opportunity is that 80% of BEAT esports audience is in the 16-34 year old demographic.

- Random stat about Twitch.tv and total active users

- Your business specific stat here (better if you have proof of concept). Ie reached 12 million total views across 6 days for Dota 2 event in Montreal, blah blah blah.

- Total addressable market stat as well

- The goal is to essentially entice the person you are pitching to continue having a discussion with you. When I first started created a pitch deck for esports, I honestly had a fairly weak statement and wasn’t sure what the problem / opportunity was for an investor. I knew that esports was the shit to me and my friends but to outsiders it was a little harder to explain.

- For example, as a tournament organizer in esports, I could say something along the long the lines of:

- Value proposition – Essentially, it comes down to why should an investor choose your product and invest in it. What is your unique selling point? Have you been doing something the longest, are you the largest, are you the most convenient? How are you 10x better than your competition.

- A good example here outside of esports can be uber.

- Uber’s value prop is convenient, safe and the driver knows exactly where you are. (This was a huge issue trying to find a cab driver :D)

- A good example here outside of esports can be uber.

- Underlying Magic – Do you have a demo? Do you have a product at all? If so, show it off. Show your event that a few thousand people have seen and show the hype. If not, make sure you have something as it’s really worth it to show off.

- Business model – What’s your business model and how are you going to get revenue? Profitability isn’t always a concern early on for investors but if your burn rate is high, you’ll need to justify why and show how you’re going to get into break even territory & eventually show a path to profitability.

- For example, as a tournament organizer my business model is tournament subs, sponsors, ticket sales, merchandise sales, crowd funding etc.

- Go to market – If you haven’t already gone to market with a proof of concept, what is your go to market plan and how are people going to hear about you / your product?

- Example, are you going to spend a million dollars just advertising your company in a one off tournament? What happens afterwards. Make sure this shows a lot of organic growth or show off your proof of concept(s) that you’ve already done.

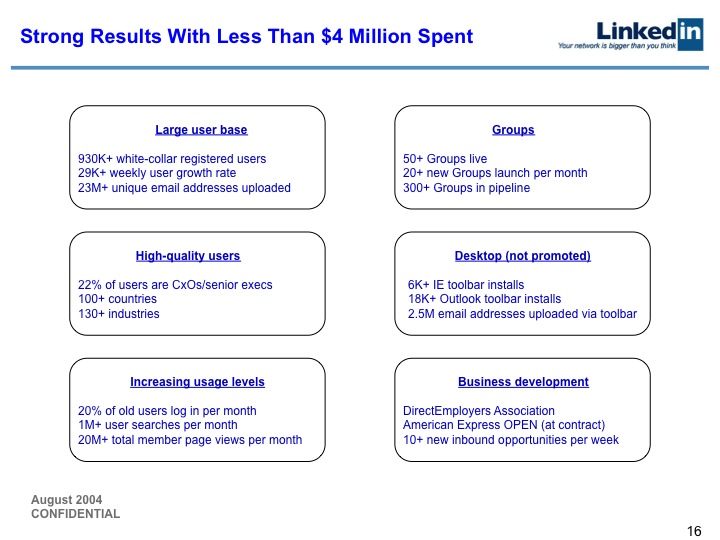

- Competitive Analysis – Make sure you outline, who are the big players, what they do well, not so well and why you’re positioned to take market share from them. If you’re struggling to find example, check some silicon valley ones. They’re great and are really in depth. Check out one of the original pitch decks from LinkedIn.

- Management Team – Describe your team and what they do / who they are. It’s ok if you don’t have a perfect team here. The goal is to get funding or at least enough traction to grow your team.

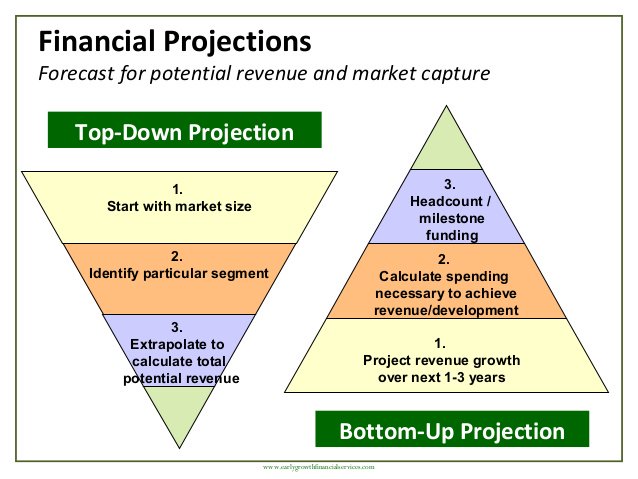

- Financial projections & metrics – You want to include rough projections just so investors know you’ve been thinking about revenue. I’ve seen some leave it off, some include it. It’s safer to include this as an appendix if you’re unsure. I prefer to keep it.

- Status, timelines, accomplishments and use of funds.

- For example, here’s LinkedIn’s slide from their Series B (if you’re going for a seed / angel investment, you have a different set of examples here). For a seed / angel investment you still want some examples of what you’ve done and how you’ll use the money. Example, ran two tournaments with a total reach of 50,000 viewers and 10,000 concurrent for a total of $1,000 (number is madeup), 2500 active social media followers. Really try to segment and learn about your audience here and show you know something about them.

After you’ve created your 10 slides, make sure you have a limited amount of bullet points. The goal is to speak on your bullet points and not read off the slide. A lot of the times the best conversations I had with investors were natural and me not even reading off anything. 30 minutes is what you’ll generally get as well IF you pass the elevator pitch too.

I’ll eventually include the pitch deck that I used to discuss with investors. I think I got about 20+ no’s but each one provided something valuable that I could alter for the next deck. I’d say I had almost 50-60 revisions until I felt it was in a spot where I felt comfortable not modifying it too much per investor.

Good luck on this and let me know of any questions. Feel free to share your experiences as well. I’ll be happy to look at any pitch decks and offer my advice. You can check my list of accomplishments here if you’re unsure about me!